What it means and why it matters

Your Credit Score

Unlock the power of your credit profile with ThreeSixty.me – your free, always-on credit score platform.

Over 10 years we help companies reach their financial and branding goals. Engitech is a values-driven technology agency dedicated.

411 University St, Seattle, USA

engitech@oceanthemes.net

+1 -800-456-478-23

Understand, Track & Improve Your Credit Score

Unlock the power of your credit profile with ThreeSixty.me – your free, always-on credit score platform.

Your credit score is more than just a number – it’s your financial passport.

In South Africa, your credit score typically ranges from 0 to 1 000, and it reflects how reliable you are when it comes to managing credit. The higher your score, the lower your perceived risk as a borrower. Lenders, landlords, insurers, and even employers may check this score to determine whether to offer you a contract, credit, or lease.

At ThreeSixty.me, we believe that everyone deserves the chance to build a strong financial future. That’s why we give you free, ongoing access to your credit score – no hidden fees, no expiry.

Your credit score is your financial voice – make it count.

You’re seen as a low-risk borrower. Likely to get the best interest rates.

Generally approved for most credit, with decent terms.

Credit is possible, but you might face slightly higher rates.

Lenders may view you as risky. Approvals might be limited.

High risk. Likely to be declined or face strict conditions.

Remember:

your score can differ slightly between bureaus based on the data they hold – and that’s normal.

Think of your score as your credit health check-up. Consistency and smart credit use keep it in shape.

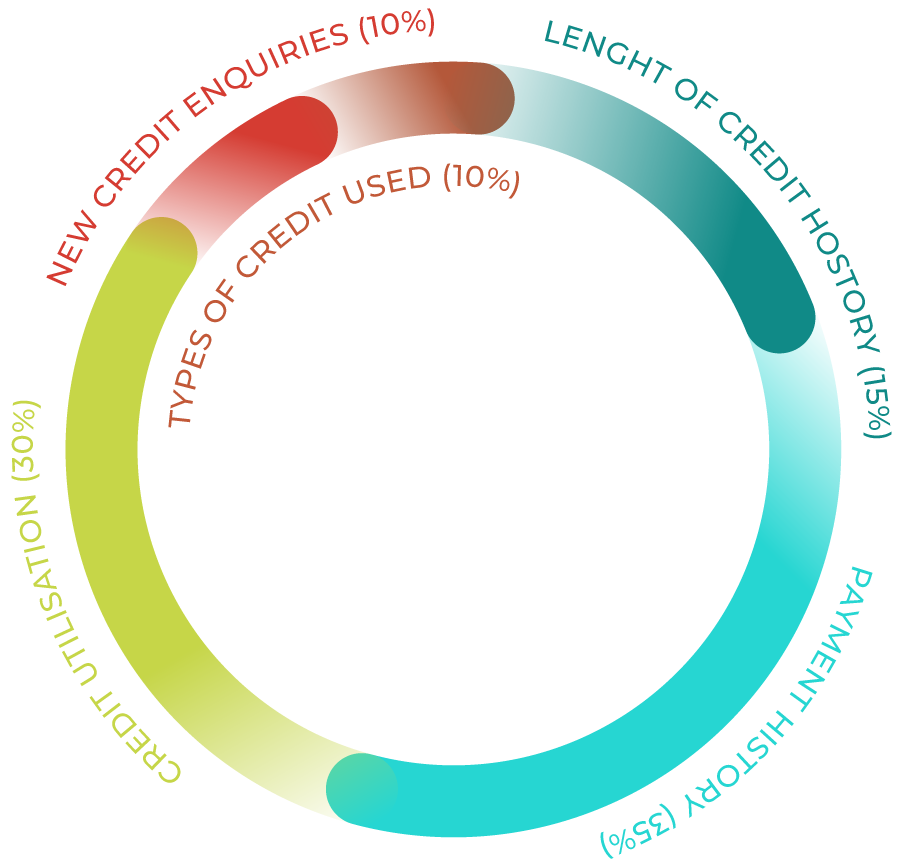

While ThreeSixty.me is not a credit bureau, we work with VeriCred Credit Bureau (VCCB) to bring you verified insights. Credit bureaus use a range of factors to calculate your score. These factors reflect your credit behaviour over time – not just one event or account.

Key Credit Score Factors:

Improving your credit score isn’t about luck – it’s about forming good financial habits. Whether you’re just starting out or need to bounce back, these actions can help you build a stronger credit profile over time:

Missed payments are the fastest way to lower your score. Set payment reminders or debit orders to stay on track.

Errors happen. Check your credit report often – and the best part? With ThreeSixty.me, you get free access, always.

Aim to use less than 30% of your credit limit. e.g. If your credit card has a R10k limit, try not to owe more than R3k.

If you’re new to credit, open a small store account and manage it well. Responsible use builds trust over time.

Every application creates a hard inquiry. If you have too many requests at once - that’s definitely a red flag.

Debt review, judgments, and defaults stay on your report for years – but they don’t have to define your future.

It’s a marathon, not a sprint. Every smart decision you make today helps your financial tomorrow.

Each credit bureau has different data and scoring models. That’s why your score may not be the same everywhere.

Usually every 30 days – depending on when lenders send updates to the credit bureau.

Yes! When you sign up with ThreeSixty.me, you can take a look at your credit report and score any time, for free.